Huge in landmass yet tiny in population and boasting one on the strictest tobacco laws on the planet, Mongolia nevertheless is a coveted market for both local and multinational companies.

By Thomas Schmid

Endless windswept steppes, horse-riding nomads living in yurts, Genghis Khan and his belligerent horde; these are probably the images most people conjure up when thinking of Mongolia. But since shaking off communism in 1990, the landlocked country of only around three million people (2016 est.) has made remarkable strides towards a free market economy and embarked on a vigorous industrialization drive especially in the vicinity of its largest city and capital, Ulaanbaatar.

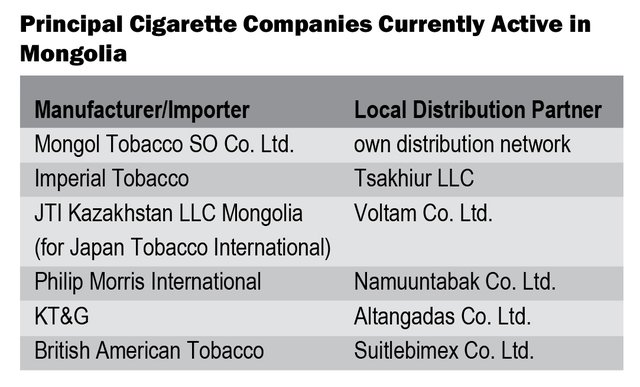

That newfound economic freedom also encouraged a number of entrepreneurs to set up a local cigarette manufacturing and distributing industry from scratch (previously, practically all cigarettes came from China and the Soviet Union). Soon after, Mongolia was “discovered” by the usual multinationals who – through local distribution partners (see table 1) – successfully introduced some of the globe’s best-known cigarette brands. The market conditions seemed favorable enough: Statistics show that about 40% of the adult population are tobacco consumers and that the average Mongolian starts smoking at an eyebrow-raising 14 years of age.

But on the ground, the legal situation is not as carefree as it may appear. Starting in 2013, Mongolia’s parliament began enacting a very stringent revision of the tobacco control law of 2005, making it one of the toughest anti-smoking laws in the world (see side box). And those harsher regulations, including the provision that tobacco sales to persons under 21 years old are illegal, forced all players to creatively adjust their marketing strategies in order to defend and develop their market shares.

Mongol Tobacco’s current brand offerings

In 2001, China Tobacco and a local businessman formed a joint venture, founding what is today Mongol Tobacco SO Co. Ltd – or as it is known by its local name, Mongol Tamkhi. While three more private local companies have since been licensed by the government to manufacture and distribute cigarettes and other tobacco products, Mongol Tobacco appears to be the only viable one. Since 2011, the company has held a very stable (and comfortable) share of 40% in the domestic market, consistently selling around 300,000 master cases of its various brands per annum. This easily outstrips each one of the five international tobacco companies that in the meantime have also become active in Mongolia, distributing their products through local partners (see table 1).

Tsogtsaikhan Otgontsetseg, r&d manager, Mongol Tobacco SO Co. Ltd.

Plenty of unused capacity

Currently employing 150 Mongolian workers and 20 Chinese staff at its plant on the outskirts of Ulaanbaatar, Mongol Tobacco currently has an annual production capacity of 2.5 billion sticks. “But we actually only utilize 50% of that,” said Tsogtsaikhan Otgontsetseg, the company’s r&d manager, adding that this figure includes an undisclosed amount of exports to countries like Angola, Vietnam, and – lo and behold – Kazakhstan and Cambodia. She was quick to point out that Mongol Tobacco is actively scouting for overseas clients in order to put that idle capacity to good use. “We can easily manufacture any desired quantity to other companies` exact product specifications. Besides, Mongolia is a very good place for tobacco manufacturing due to its favorable legal and tax framework.”

Furthermore, Mongol Tobacco would be very keen to enter into manufacturing agreements with any of the big multinationals, all of whom currently have to import their merchandise into the country. “We also would like to produce [the] international brands of multinational companies in our factory for their [local] distribution partners,” Otgontsetseg said. Such a potential manufacturing agreement could of course help save the respective companies considerable costs for logistics and import taxes.

While Mongol Tobacco primarily uses American blends of Brazilian, Chinese, and Indian Virginia and burley tobaccos in its own product range, Otgontsetseg asserted that clients can actually determine what specific blend they’d require. Mongol Tobacco also has a production line for cigarette filters, using acetate tow from Japan’s Mitsubishi Royal Corporation as raw material. While a quantity of the filters are used in-house, there is enough capacity still to also fill orders from other cigarette companies at home and abroad. Papers and packaging materials, meanwhile, are mostly supplied by China.

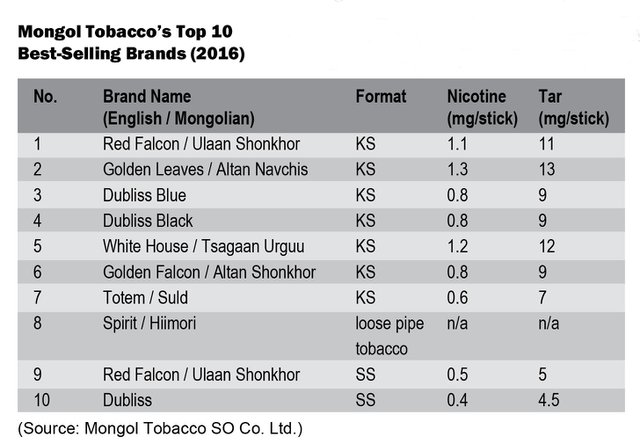

Mongolian smokers like it big – or do they?

There is a definite preference among Mongolian smokers for filtered king size cigarettes, according to Otgontsetseg. Non-filters are generally shunned because they’re regarded as “low class”. “But we also have been seeing a steady rise in the popularity of the superslim format,” she said, adding that this development has prompted Mongol Tobacco to acquire a brand new production line for superslim cigarettes, which was expected to go into operation by October 1 this year. “If I had to break it down, I’d say that currently about 70% of our domestic sales are king size cigarettes, 25% are superslims, and the remaining 5% are loose pipe tobacco, which we also produce,” Otgontsetseg elaborated.

Taking pride in standardization

As Mongolia’s most successful indigenous tobacco company to date, Mongol Tobacco in 2011 received the coveted ISO9001:2008 certificate, which acknowledged the company’s wholesome compliance with and concerted implementation of HACCP food production standards.

“We were really excited about it, as all our efforts had been rewarded,” enthused Otgontsetseg, adding that receiving the certification not only would help create trust among potential foreign customers in the world class quality of the company’s products and its production facilities, but “hopefully also will open us the door to export to more countries”.

Imperial Tobacco – bringing west to the east

Even before the very first cigarette pack emerged from Mongol Tobacco’s production line, the country had already attracted the attention of multinational tobacco companies. Arguably one of the first to enter this – back then - almost virgin market was Imperial Tobacco, which as early as 1998 established a distribution partnership with local company Tsakhiur Group and launched its brands West and Davidoff. After Imperial Tobacco had acquired German company Reemtsma in 2002, that range was subsequently further expanded by the cigarette brand Polo and the pipe tobacco brand Dunza.

“From our portfolio [in Mongolia], the most popular brand is West Red, [but] our Dunza pipe tobacco also remains a firm favorite with adult smokers,” said Dinmukhamed Aisautov, Imperial Tobacco’s corporate affairs manager for Central Asia & Mongolia. He also confirmed Otgontsetseg’s assertion that while the king size format is still very popular in Mongolia, sales of superslims have continuously gained further ground over the last few years. Aisautov likewise confirmed Mongolian smokers’ preference for filtered cigarettes. “Cigarettes with filters are the preferred choice of adult smokers in Mongolia, [as] brands with no filters are viewed by consumers as being a less premium offering and are not perceived to have the same quality as brands with filters,” he said.

Feeling up the market

All of Imperial Tobacco Tobacco’s brands currently marketed in Mongolia are imported and the company has no immediate plans to set up any manufacturing plant in the country. But that doesn’t mean that Imperial Tobacco is not very keenly monitoring market trends and scouting for additional new opportunities. Aisautov: “We are always monitoring market trends to ensure our brands remain relevant and reflect evolving consumer preferences. We also have plans to introduce some innovative launches [in] the Mongolian market over the next year, but we can’t reveal any details at present as they are commercially sensitive.”

Favorable market share gains

According to Aisautov, Imperial Tobacco’s domestic market share has risen to just over 16% in 2016, compared to the 11% the company held in 2015.

“Due to the allocation of increased resources and investments in the Mongolian market we have managed to develop our volumes by more than 30% over the past year, which has also seen our market share increase from 11% to over 16%,” Aisautov claimed. This promising market development seemingly provides Imperial Tobacco with a very comfortable position, prompting Aisautov to conclude: “We welcome any competition in the markets in which we operate as this ensures [that] consumers have a wide range of brands and products from which to choose. In Mongolia we compete with JTI and the local company, Mongol Tamkhi.”

Alena Stepanichsheva, external communications manager, JTI in Kazakhstan, Central Asia, and Mongolia

Japan Tobacco International – sweeping in from Kazakhstan

Arriving on the scene somewhat later than Imperial Tobacco, Japan Tobacco International (JTI) has since 2003 maintained a distribution partnership with local outfit Voltam Co. Ltd., an arrangement that dates back to an earlier time when cigarette manufacturer Gallaher in neighboring Kazakhstan had supplied its products to Mongolia. In 2007, Gallaher was acquired by JTI. Subsequently, the new JTI Kazakhstan subsidiary established a representative office in Ulaanbaatar under the moniker JTI Kazakhstan LLC Mongolia. According to Alena Stepanichsheva, external communications manager of JTI in Kazakhstan, Central Asia, and Mongolia, this quite intriguing company set-up allowed JTI to not only introduce its international brands to Mongolia but also continue selling some of the brands formerly owned by Gallaher. “Apart from the classic JTI brands Winston and Mevius, we also sold Argymak Mongolia, Sobranie, Sovereign, LD, and State Line,” she explained.

Consumer loyalty keeps LD at the top

Just like with Imperial Tobacco, all JTI-owned brands are imported without exception and the company does not currently maintain a manufacturing facility in Mongolia. Stepanichsheva said that LD currently was the company’s best-selling brand in the country, which she attributed to the fact that it’s been available for so many years and because Mongolian consumers tend to be rather brand-loyal. King size filtered cigarettes continue to be the preferred format (“The choice of non-filtered cigarettes in the market is very limited anyway.”), she said, directly corroborating what Mongol Tobacco and Imperial Tobacco had already established. While Stepanichsheva declined to comment on JTI’s current market share in Mongolia, she disclosed that she considered JTI’s main competitors to be Mongol Tobacco, Philip Morris International (PMI), and Korea’s KT&G.

A hotly contested turf

Although PMI and KT&G together with British American Tobacco are having a presence in Mongolia, Tobacco Asia unfortunately was unsuccessful in securing interviews with them. Mongolia, that vast, land-locked country with its miniscule population may not have much influence in world politics and despite its reportedly tremendous but still largely untapped mineral resources play an insignificant role in global economics, but one thing seems clear: If the somewhat reluctant responses and thin data we gained from our inquiries are any indication, Mongolia is nevertheless a hotly contested turf among the multinationals. Meanwhile, Mongol Tobacco appears to lean back with a cushy lion’s share of the market - and even has utilized only half of its production capacity.

info@mongoltamkhiso.mn

R&D Managerodgerel@mongoltamkhiso.mn

Telephone+ (976) 70171080, + (976) 70171099

Fax+ (976) 70009573